No matter what self-employment looks like for you, you’re responsible for ensuring the taxes on your net earnings are paid to the Internal Revenue System (IRS). And the self-employment tax (SE tax) is part of that.

Officially known as the Self-Employment Contributions Act tax, the SE tax is the self-employed community’s version of the taxes paid by employers and their employees for Social Security and Medicare.

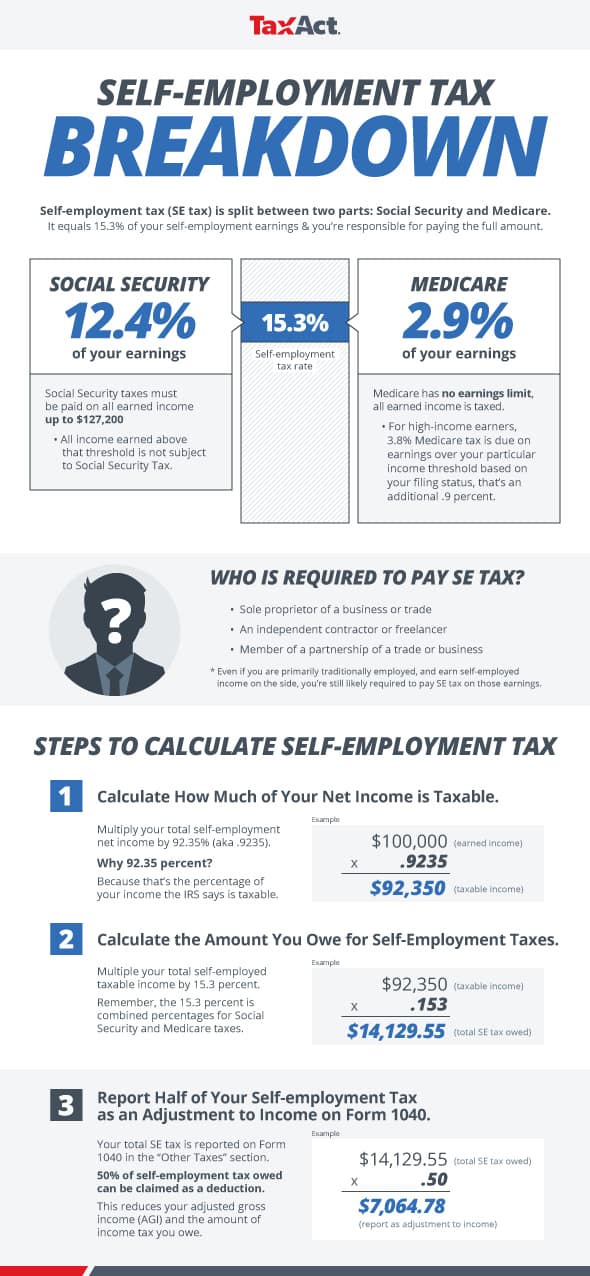

Whether you run a bakeshop on the weekends, author blog posts as a freelance writer or design logos for local businesses, you should know how the SE tax impacts your money. Follow the infographic below to calculate the SE tax on your 2017 self-employment income.

The post How to Calculate the Self-Employment Tax appeared first on TaxAct Blog.